First, contrary to popular belief, we don’t need to tax the rich to pay for government spending. Congress has authorized the Federal Reserve System (FED) to create as much money as the government needs for any congressionally approved purpose. This is commonly called “modern monetary theory,” but it is simply how the U.S. monetary system operates. (Check out the 14-minute video by Stephanie Kelton at the end of this post.) Congress doesn’t need to cut Social Security, Medicare, Medicaid, SNAP, or any other social program to offset tax cuts. As explained in my previous posts, Congress could instruct the FED to pay off the national debt if it chose to do so, and could do so without raising taxes.

Whenever the government needs money, the FED simply credits or deposits funds in the Treasury General Account (TGA), which serves as the government’s checking account at the FED. Taxes are also deposited or credited to the TGA. However, the government doesn’t need to depend on collecting taxes or borrowing money to pay its bills or keep its financial promises. The government can, and does, create as much money as it needs to fund congressionally authorized purposes.

A primary reason for taxation is to moderate inflation in prices and maintain the value of money. The government spends money to acquire “public goods and services,” meaning things that benefit society but for which there is too little or no economic incentive to provide, such as national defense, law enforcement, public schools, highways, and bridges. In such cases, nothing is produced that can be bought with the money the government’s spending puts in circulation. Taxes provide a means of removing excess money from circulation to avoid creating inflation, which would diminish the buying power of all money in circulation.

If tax revenues aren’t sufficient to remove any excess money from circulation, the U.S. Treasury has typically resorted to selling government securities to mitigate inflation, which increases the national debt. However, the government must pay interest on securities to attract investors or depositors, which puts some of the money borrowed back into circulation. Taxes are the most effective and efficient means of mitigating inflation that might otherwise be caused by government spending.

Another purpose of taxes is to provide economic incentives for individuals and businesses to do things that serve the public interests and to stop, or not begin, doing things that are detrimental to public interests. Income tax deductions for interest paid on home and student loans incentivize home ownership and higher education. Tax credits for children and childcare provide incentives to start families. Tax credits for solar panels and energy-efficient home heating and cooling systems incentivize the transition to renewable energy. Taxes on tobacco, alcohol, and gambling, and proposed taxes on soft drinks, junk foods, greenhouse gas emissions, and other environmental pollutants are means of discouraging activities harmful to the public.

But why should those with higher incomes be taxed at higher rates? The primary justification for taxing the rich is to maintain some sense of equity of economic opportunity within society. There is a natural tendency for capitalist economics to make those with wealth even wealthier, even if they contribute nothing more than money to the economy. Once people have money, their money makes money for them. Money saved can earn interest, and money invested can yield a return on investment or profit, without the people with money doing anything more than deciding what to do with their money. They can even hire someone else to make their decisions and pay their money managers with money made by their money. The more money they have, the more money their money can make for them. And if they make a bad investment, they can simply declare bankruptcy, cut their losses short, and start over. It’s difficult to go broke, or even to avoid becoming wealthy, once you have money.

Some of the wealthy started out in life with very little and worked hard and smart to become rich. I don’t mean to diminish their economic accomplishment, assuming they didn’t take advantage of others to get what they have. Some people are very good at doing things that make money. My point is that once people have money, the current tax code makes it relatively easy for them to make more and more money.

You don’t have to take my word for it. Take it from the “Patriotic Millionaires.” Some people with lots of money understand why we need to “Tax the Rich” at higher rates to regain the sense of economic equity essential for a livable society, for the rich as well as the rest of us. From their recent “Tax Day” post, “Our tax code has failed abysmally in recent years in fulfilling its role to put a check on extreme inequality, as it once did in the mid-20th century. In 1945, the top marginal income tax rate was 94%; today, it’s 37%.

In 1945, the estate tax had a top marginal rate of 77% and applied to estates worth over $60,000 (or roughly $1 million in today’s dollars); now, it has a 40% top rate and a $13.99 million exemption threshold. In 1950, the top 400 richest Americans paid an overall tax rate on all their federal, state, and local taxes of 70%; in 2018, they paid 23%, which was less than any other income group.” They note that these changes happened under both Democratic and Republican administrations.

The Patriotic Millionaires also point out the fallacies in claims that the wealthy pay a larger portion of their incomes in taxes than do the rest of us. Those claims include the matching Social Security and Medicare taxes paid by employers and taxes on real estate, profits, and other business taxes paid by their corporations. The calculations also leave out the “tax credits” and loopholes that allow corporations owned by wealthy individuals to avoid most, if not all, taxes on profits. The inflated tax claims on wealth include estimates of estate taxes, due at the time of death, on income that has accumulated tax-free as capital gains during their lifetime, rather than being taxed annually.

A capital gain is simply the increase in dollar value of something you own, like the increase in value of your home, IRA, corporate stock, or piece of real estate. The capital gain is the return on your investment. It’s your money made by your money. You aren’t taxed on the capital gains or increases in value of assets until you sell whatever you own. With an annual return of 15% on investment or capital gain, which is low for investment opportunities of multi-millionaires, the amount of money invested doubles every 5 years, tax-free. So, the money of many of those who die wealthy has been making money for them, tax-free, for decades, and according to current estate tax law, nearly $14 million of it is still tax-free.

In addition, taxes on capital gains, on money made by money, are lower than taxes on ordinary income, or money made by working. To begin with, the standard deduction, or income level at which additional income becomes taxable, is three times higher for capital gains than for ordinary income. The standard deduction for ordinary income for individuals filing separately is $14,600, for married couples filing jointly, $29,200, and for heads of households, $21,900. The standard deduction for capital gains for individuals is $47,025, for married couples filing jointly, $94,050, and for heads of households, $63,000.

Standard Deduction; Ordinary Income:

$14,600 for single or married filing separately

$29,200 for married couples filing jointly or qualifying surviving spouse

$21,900 for head of household

Standard Deduction; Capital Gains:

$47,025 for single and married filing separately;

$94,050 for married filing jointly and qualifying surviving spouse; and

$63,000 for head of household.

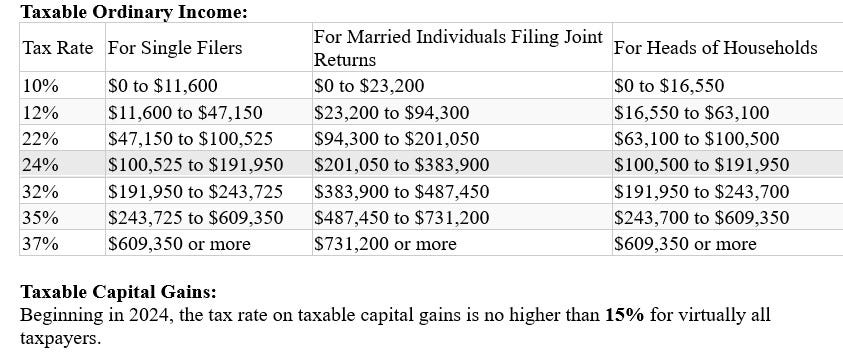

For a married couple, the tax rate on taxable ordinary income, after deduction, varies from 10% of the first $23,200, to 12% on the next $71,100, to 22% on the next $106,750, up to 37% on incomes above $731,201. For capital gains, the tax rate is a flat 15% for all taxable gains, after a three-times higher standard deduction. A couple with $50,000 in taxable income is paying a marginal tax rate, or tax on each additional dollar, within 3% of the marginal tax rate of a millionaire, and a couple with more than $100,000 in taxable income is paying a marginal tax rate more than 45% higher than multi-millionaires pay on their capital gains. In addition, the multi-millionaires only start paying after they get three times as much tax-free.

The current tax structure in the U.S. is not ensuring equity in economic opportunities that are essential for a livable society for the rich or the rest of us. The continuing failure to tax the rich virtually ensures that the wealthy will become even wealthier, even if they do nothing productive, and the disparity between the wealthy and the rest of us will continue to grow wider. This is not a time when the government should even be considering cutting taxes, and certainly not cutting taxes even further for the rich. So-called deficit spending, or differences between government spending and tax revenues, does not necessarily lead to inflation, even without government borrowing. However, the differences projected if current tax cut proposals are implemented could result in major disruptions of the national and global economies.

Regardless of whether money is created by government spending or commercial bank lending, once created, the money continues to circulate through the commercial banking system in the private economy. The money paid to government workers and contractors is deposited in commercial banks, where a minimal amount is kept in reserve. The rest is loaned out to businesses and individuals who spend it, creating new investment capital and income to be deposited, loaned out again, and reinvested or re-spent. This process may result in ten times as much money in circulation as the initial government spending. However, the additional investments and employment may result in enough “additional” goods and services to buy with the new money in circulation, thus avoiding inflation. Also, the taxes on profits and incomes resulting from multiple rounds of investments and spending may more than offset the initial deficit spending.

However, the difference between U.S. government spending and tax revenues for the current fiscal year is about $2 trillion. If the current congressional budget framework is implemented, the difference between government spending and revenues would increase by another $4 trillion over ten years. This estimate includes a cut of $2 trillion in government spending. Most of the cuts would come from Medicaid and SNAP, but Medicare and Social Security are also at risk. If cuts to these programs are not fully implemented, the disparity between spending and revenues would be even greater. If the government sells securities to remove the excess money from circulation, the interest cost on the additional government “borrowing” would increase the disparity between government spending and taxes by another $0.6 trillion.

In other words, if Congress implements the current government budget framework, the government will put a tremendous amount of new money in circulation that will not be offset by tax revenues. The economy is already producing at near full capacity with low levels of unemployment and limits on other resources needed to support economic growth. If increases in the money supply are not offset by removing a similar amount of money from circulation, the result will be inflation in prices for virtually everything.

This would add to the inflation anticipated from the market disruption and costs associated with higher tariffs on imports, which are yet to be determined. It would take 40% tariffs on all imports at current import levels to offset budget deficits. If tariffs succeed in reducing imports, which is their purpose, tax revenues from tariffs would fall accordingly. If Congress forces the government to offset the difference by “borrowing,” the interest costs of government securities will add another $0.6 or more to the projected $4 to $5 trillion increase in the “national debt.” There are no easy solutions to the current economic dilemma.

Congress could authorize the government expenditures to continue funding Medicaid, Medicare, Social Security, SNAP, and other government programs without raising taxes or borrowing. The FED could remove enough money from the private economy to offset the increased amount of new money put in circulation by government spending. However, this would require increasing interest rates to discourage private-sector borrowing, investing, and spending. This would risk reducing business investments, increasing unemployment, and plunging the economy into a recession. This is the dilemma the Trump administration has created for the FED, which is trying to keep interest rates high enough to moderate inflation but low enough to avoid a recession.

The most logical response to the current economic dilemma is not needless cuts to social programs that increase social equity for the needy, not increases in sales of government securities that increase interest costs for the government, and not tariffs or sales taxes to be paid by the middle-class, but instead, increased equity of economic opportunity for all by increasing, rather than decreasing, tax rates for the rich.

John Ikerd

Modern Monetary Theory:

Stephanie Kelton (14 minute TED talk):

Patriotic Millionaires:

https://patrioticmillionaires.org/priorities/tax-the-rich/

https://patrioticmillionaires.org/perspectives/happy-tax-day-america-tax-the-rich/

https://patrioticmillionaires.org/perspectives/oppressive-taxation-that-isnt/

The Book: Tax the Rich: https://www.amazon.com/Tax-Rich-Loopholes-Lobbyists-Richer/dp/1620976269/ref=asc_df_1620976269?

Other Links:

https://www.irs.gov/credits-and-deductions-for-individuals#:~:text

https://www.irs.gov/taxtopics/tc409

https://taxfoundation.org/data/all/federal/2024-tax-brackets/

Excellent summary of the situation. Backed by the work of so many economists. Prof Steve Keen is now either #1 or #2 for podcasts and YouTube on economics in Europe and the UK. Do you have anyone local to take the next step and make this more accessible as in Videos? Or maybe Bernie or AOC can use these ideas in a speech?

What form of taxation- wealth, income, capital gains, inheritance caps? Thorough and a good read John, thank you.